unlevered free cash flow dcf

Multiply by 1 Tax Rate to get the companys Net Operating Profit After Taxes or NOPAT. By using unlevered cash flow the enterprise value is.

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered free cash flow is used to remove the impact of capital structure on a firms value and to make companies more comparable.

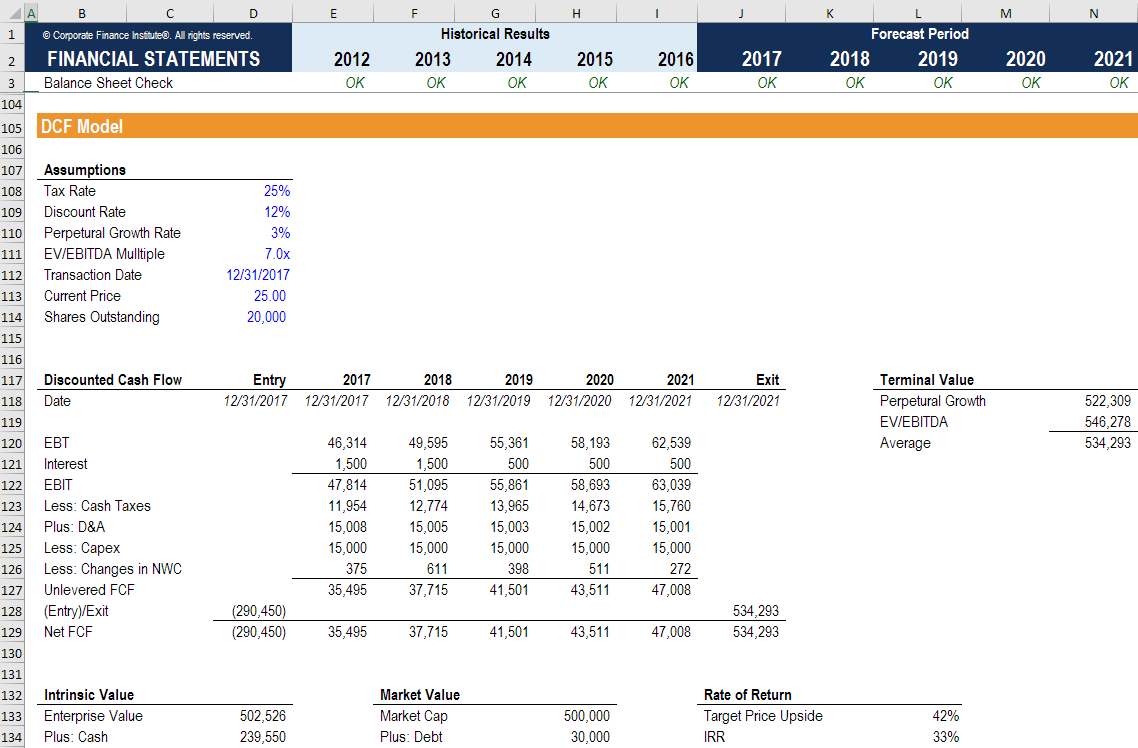

. You can use the levered or unlevered free cash flow to value a company using the DCF method of valuation. Lets see the use of the formula in the DCF model in the example below. Sep 29 2010 - 236am.

If we assume that WACC 11 and that the appropriate long-term growth rate is 1 we get. We begin the DCF analaysis by computing unlevered free cash flow. However there are different situations when you prefer one over the other.

This article discusses three specific instances when you should use the unlevered. Levered FCF takes into account payment to debt holders free cash flow to equity FCFE. WACC Cost of Equity Equity Cost of Debt 1 Tax Rate Debt Cost of Preferred Stock Preferred Stock.

Its principal application is in valuation where a discounted cash flow DCF model is built to determine the net present value NPV of a business. However we also need to ensure the company has enough cash to pay down its debt obligations in an acquisition scenario. Both approaches can be used to produce a valid DCF valuation.

Revenues 2020 77867 million. A DCF valuation will not directly apply a levered free cash flow metric into its formula as it uses unlevered free cash flows as the proxy for estimating an assets value. The Weighted Average Cost of Capital WACC covered in the next section of this training course.

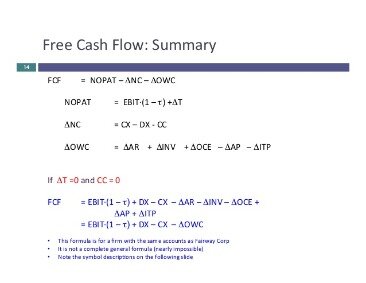

The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at WACC less the value of non-common share claims such as debt. Unlevered free cash flow is generated by the enterprise so its present value like an EBITDA multiple will give you the Enterprise value. And we know that NOPAT EBIT 1 Tax Rate.

Since yourre taking out interest expense all the free cash flow is available to equity holders. The authors thesis is that Amazon stock is overvalued because the definition of FCF that management uses and that presumably is used by stock analysts to arrive at a valuation for Amazon via a DCF analysis ignores significant. Unlevered FCF EBITDA CapEx Working Capital Tax Expense.

Unlevered FCF is cash flow available to everyone free cash flow to firm FCFF free cash flow available to equity AND debt holders. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity holders. G the perpetual growth rate.

A business or asset that generates more cash than it invests provides a positive FCF that may be used to pay interest or retire debt service debt holders or to pay dividends or buy. Unlevered free cash flow is the gross free cash flow generated by a company. Present Value of Terminal Value.

Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Electromagnetic Geoservices ASA EMGSOL 23 NOK-007 -275. Levered Free Cash Flow vs Unlevered Free Cash Flow.

Unlevered Free Cash Flow Formula. If you use an unlevered free cash flow value with interest expense. FCF n last projection period Free Cash Flow Terminal Free Cash Flow.

The following inputs will be our basis to find the fair value. See the discussion of unlevered free cash flow in the valuation section for more detail on how to perform this step. Unlevered Free Cash Flow.

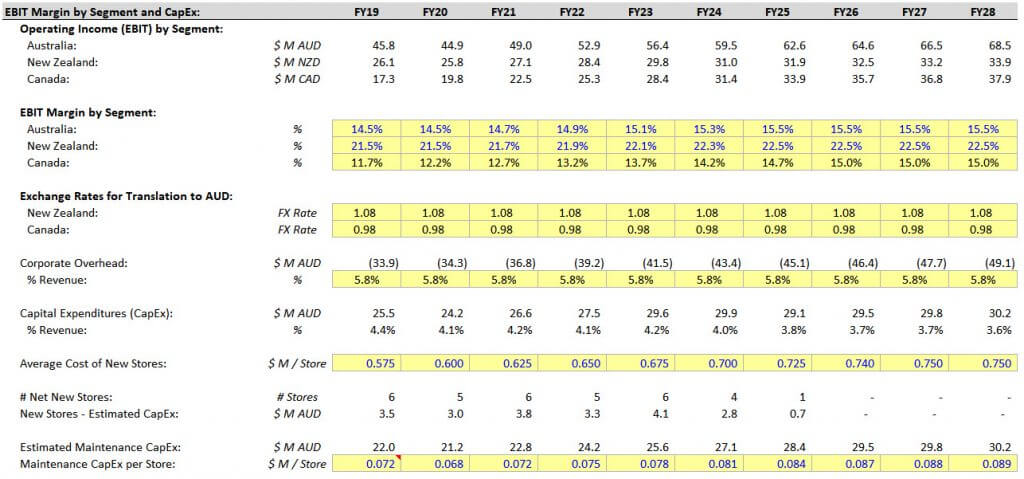

DCF Model Step 2. DCF Model Step 3. The model assumes an 80x EVEBITDA sale of the business that closes on 12312022.

More on that in the next section. Example from a Financial Model. And here are the relevant files and links.

Most investment banking firms follow our guidelines to get discounted cash flow statement of companies to see if they are undervalued. But levered FCF does indirectly affect a DCF. Walmart DCF Corresponds to this tutorial and everything below.

Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. Unlevered Free Cash Flow. As you will notice the terminal value represents a very large proportion of the total Free Cash Flow to the Firm FCFF.

R the discount rate aka. A recent SeekingAlpha blog post questioned Amazon managements definition of free cash flows FCF and criticized its application in DCF valuation. To build this model we will take the data we calculated from Intel in 2020 and project what kind of value the company is worth.

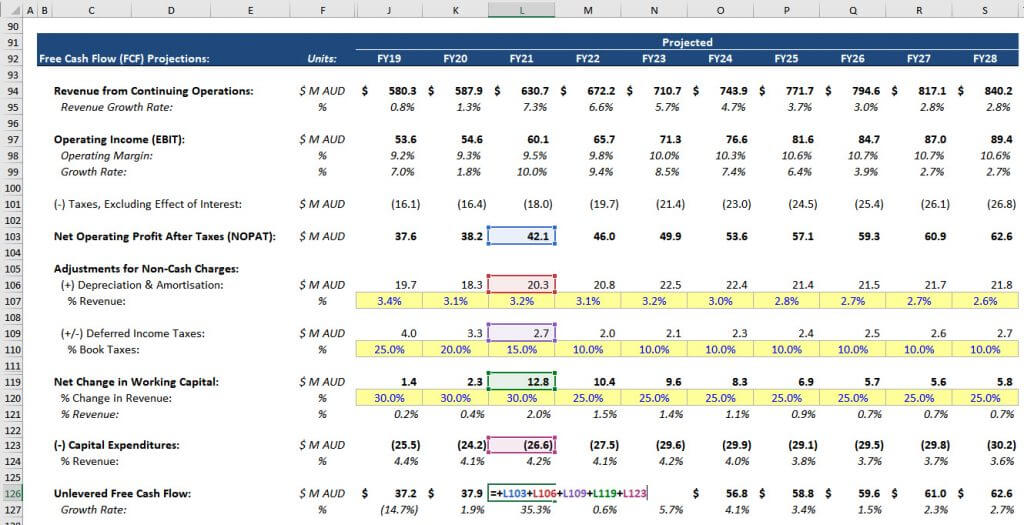

Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx. Unlevered Free Cash Flow Formula in a DCF. Financial Modeling Prep Discounted cash flow Model Markets Data Login Sign Up AAPL 13276 087999 066726536 FB 19664.

DCF Model Step 1. In the given example we have already put historical values from financial statements into the model. The present value or leveraged free cash flow LFCF or equity cash flows discounted at the cost of.

Putting Together the Full Projections. Unlevered Free Cash Flow - UFCF. Common Criticisms of the DCF and Responses.

If you use a levered free cash flow value with interest expense subtracted you are effectively calculating an equity value with a DCF model and so discount rate is just cost of equity all other forms of capital dont matter. Start with Operating Income EBIT on the companys Income Statement. Unlevered Free Cash Flow.

How to Calculate Unlevered Free Cash Flow. Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. Unlevered free cash flow can be reported in a companys.

DCF Implications for Both. If not the intrinsic value is not worth much because the company will be defunct. Free cash flow t 1 069.

Below is an example of a DCF Model with a terminal value formula that uses the Exit Multiple approach. To calculate the value of a company using a discounted cash flow DCF model we use unlevered free cash flow to determine its intrinsic value. Heres a formula for UFCF.

For a standard DCF based on Unlevered Free Cash Flow ie a companys core-business cash flows available to all investors in the company WACC is the appropriate Discount Rate. Unlevered Free Cash Flow STEP 33. Add back the companys Depreciation Amortization which is a non-cash expense.

This is a very conservative long-term growth. Well free cash flow should correspond with your discount rate. WhyWhen do you use unlevered FCF when valuing a company using the DCF method.

This represents the companys earnings from core business after taxes ignoring capital structure. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Discounted Cash Flow DCF Analysis Unlevered.

Unlevered FCF Net Income DA Capex Working Capital.

Unlevered Free Cash Flow Definition Examples Formula

How To Calculate Unlevered Free Cash Flow In A Dcf

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

How To Calculate Unlevered Free Cash Flow In A Dcf

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Analysis Street Of Walls

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Formula Formula For Free Cash Flow Examples And Guide

Unlevered Free Cash Wave Accounting

Understanding Levered Vs Unlevered Free Cash Flow

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial